Which of These Is the Best Example of Fiscal Policy

The Fed lowering interest rates B. Examples of fiscal policy include changing tax rates and public spending to curb inflation at a macroeconomic level.

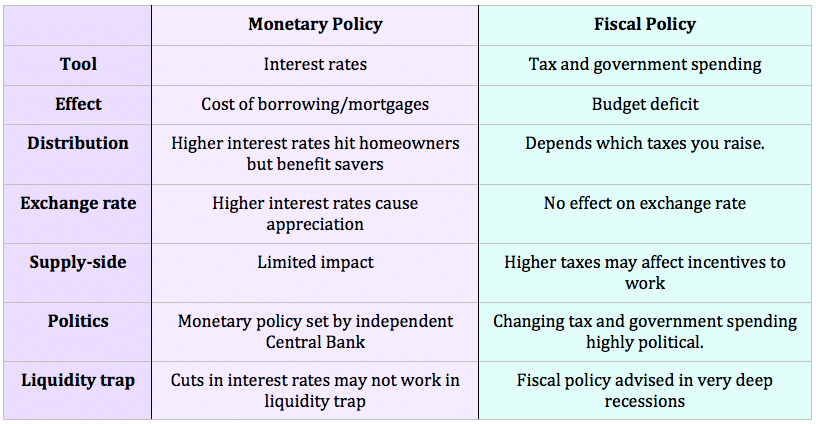

Monetary Policy Vs Fiscal Policy Economics Help

Unemployment insurance payments increasing during a recession D.

. For example if the government pursue expansionary fiscal policy but interest rates rise and the global economy is in a recession it may be insufficient to boost demand. Explore how fiscal policy is developed in the United States and discover some definitions of what this policy is as well as the different approaches that have been taken. Who has the most responsibility for monetary policy.

A tax cut passed by Congress to fight a recession B. C fiscal policy may often be destabilizing if the effects of. A tax on farm products C.

Asked Mar 11 2021 in Economics by Gumball. Income tax receipts increasing during an expansion due to rising incomes C. Fiscal Policy of an economy is the responsibility of the Government.

While all governments rely on fiscal policy to promote economic growth politicians and economists are constantly debating how and when government. In early 2021 President Joe Biden signed a comprehensive 1. For example in India Finance Minister is in-charge of the fiscal policy and it is decided discussed and implemented by the.

Creating federal jobs so workers can spend more. The government raising taxes. The best example of fiscal policy is ___.

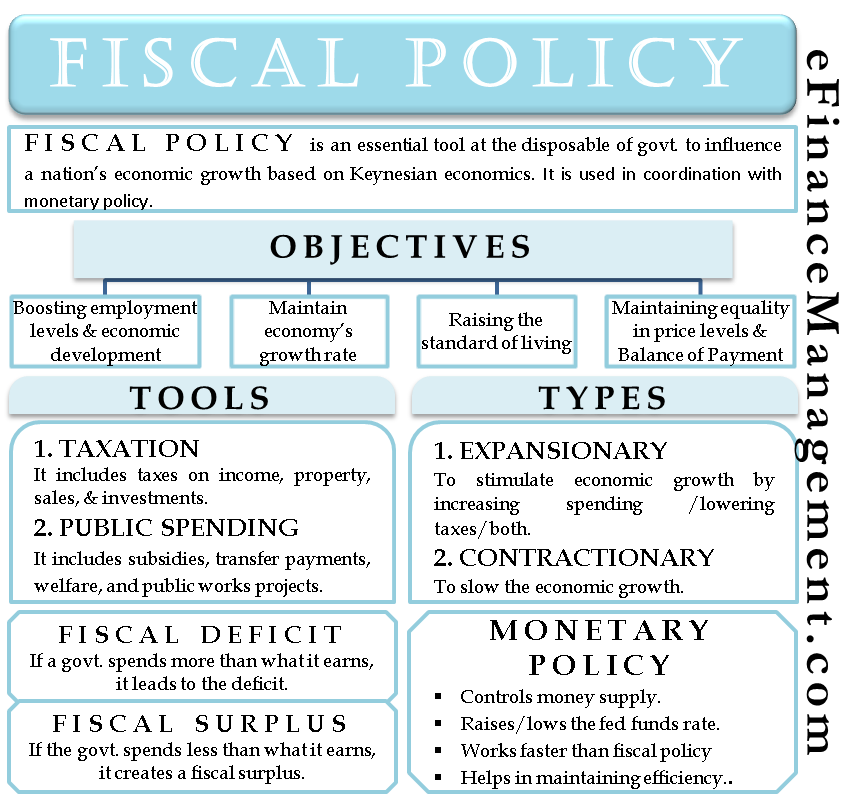

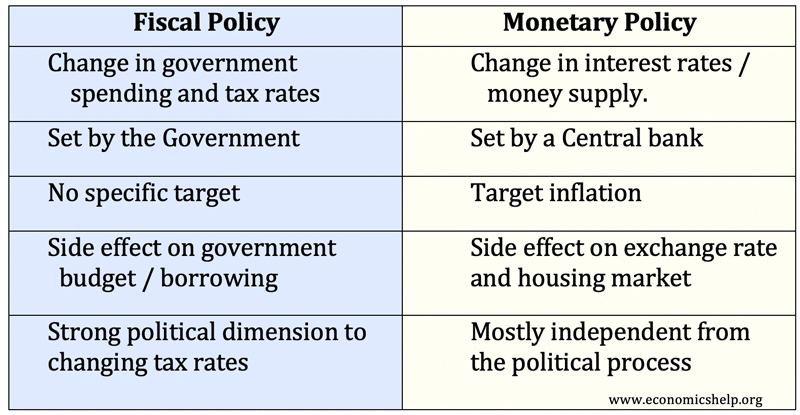

Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals. Monetary policy addresses interest rates and the supply of money in circulation and it is generally managed by a central bank. Can fiscal policy and monetary policy be at odds with each other.

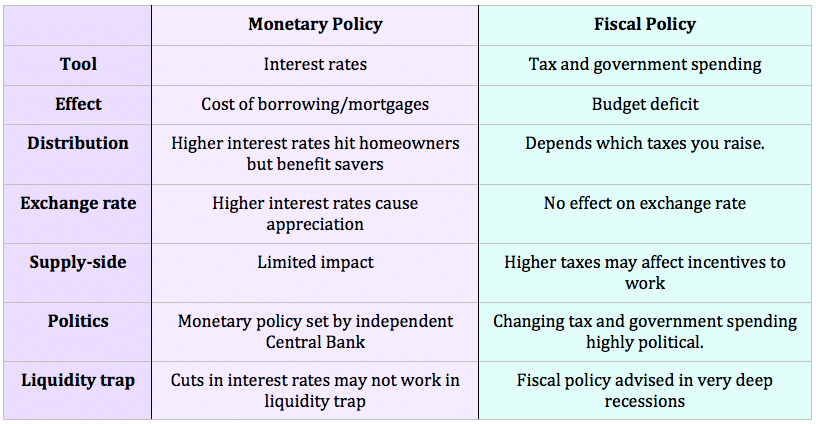

A regulation on banking B. Fiscal policy is how governments adjust their spending levels and tax rates so they can influence the economyIt touches many parts of society including businesses households and infrastructure. Answered Mar 11 2021 by arkuda.

When combined with monetary policy fiscal policy makes up economic policy which is how governments attempt to influence and regulate the economy. Other examples include extending tax cuts to counteract a cut in government spending to avoid causing an economic recession. Fiscal policy refers to the use of government spending and tax policies to influence macroeconomic conditions including aggregate demand employment inflation and.

If Congress raises taxes on the super-rich thats fiscal policy. In the United States the president influences the process but Congress must author and pass the bills. Which of these agencies has primary responsibility for preventing price fixing and bid rigging.

When the government distributes stimulus payments to Americans bank accounts thats another example of fiscal policy. It can also be a tax or a tariff on a small range of products. That can happen when the Fed lowers interest.

The usual goals of both fiscal and monetary policy are to achieve or maintain full employment to achieve or. Economic expansion causing a decrease in the number of food stamps issued. Congress passed the American Taxpayer Relief Act of 2012.

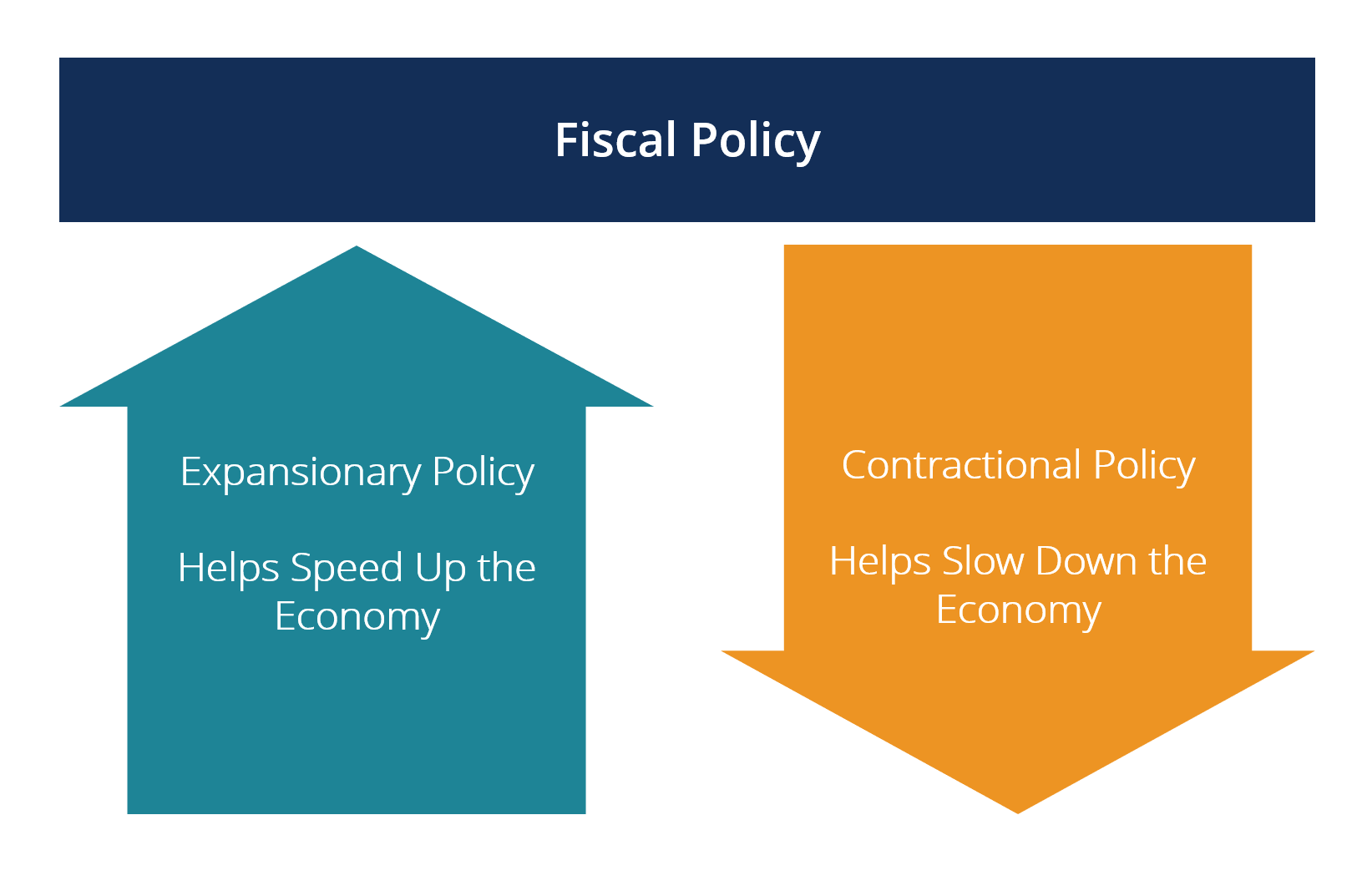

Fiscal policy addresses taxation and government spending and it is. Expansionary fiscal policy is when the government expands the money supply in the economy using budgetary tools to either increase spending or cut taxes both of which provide consumers and businesses with more money to spend. Which option is the best example of a fiscal policy.

The government raising taxes. Which of the following is an example of discretionary fiscal policy. The enormous 52 trillion US.

A fiscal policy is effective only slowly but the slowness ensures that it is effective in the long run. A great example of fiscal policy being used that shows both tools of taxes and government spending US response to the covid-19 pandemic. B fiscal policy is most effective as a short-run measure to fine tune the economyʹs quarterly ups and downs.

What is the best example of fiscal policy. Fiscal policy measures employed by governments to stabilize the economy specifically by manipulating the levels and allocations of taxes and government expenditures. There is also an effort to keep monetary policy from being used as a political tool as this could cause great damage to an economy and nation.

These both have significant influence on the economy. A law on voting rights. It is considered important to strictly separate institutions that manage these two policies due to the risk of fiscal dominance.

Fiscal response to the COVID-19 pandemic likely has put the economy on a path to recovery but it may end up discouraging future spending on other pressing needs. A policy on printing money D. If there is concern over the state of government finances the government may not be able to borrow to finance fiscal policy.

Fiscal policy was shown after the US. These are the central questions of fiscal policy.

What Is Fiscal Policy Its Objectives Tools And Types

Difference Between Monetary And Fiscal Policy Economics Help

Fiscal Policy Overview Of Budgetary Policy Of The Government

No comments for "Which of These Is the Best Example of Fiscal Policy"

Post a Comment